I bet you wish you never burned that bridge (oh nooooo, ‘cause now you’d like to cross it)

— Shaggy alongside Chronixx

There is loads of VC money sloshing around the startup ecosystem these days. if you need proof, the recent reports from both CB Insights and Crunchbase bear this out.

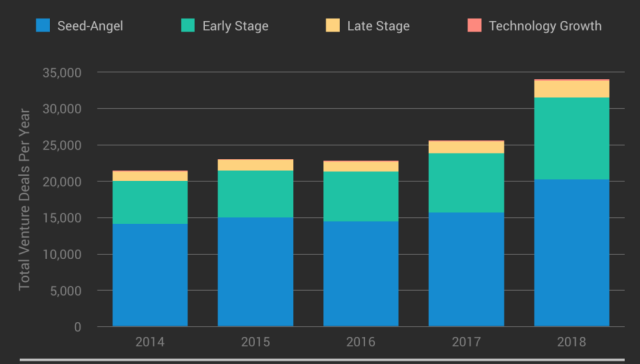

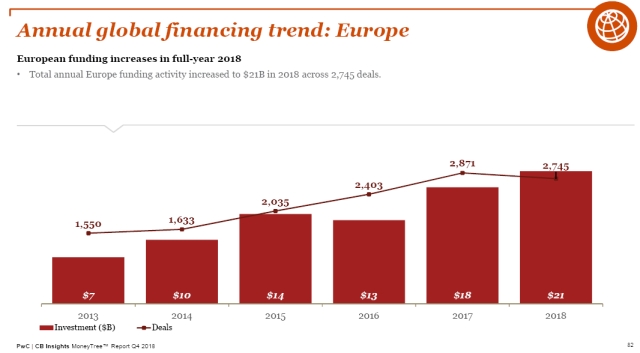

With just over 34,000 venture deals projected for 2018, last year was the most active on record. Overall deal volume jumped by over 32 percent since 2017. While the U.S. remains the largest market for venture capital, these trends are the same in Europe…

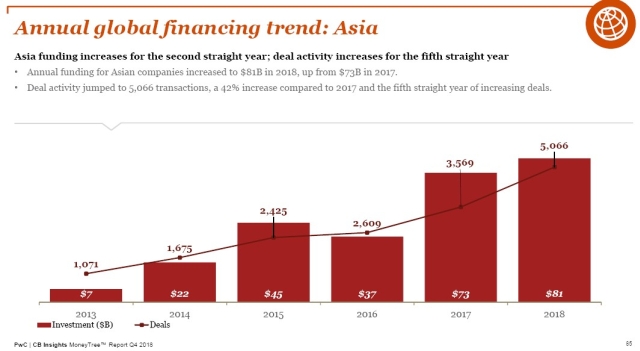

… and in Asia :

This period of abundant capital was not always the case, even if it might seem ages ago to many, and be totally unfamiliar to an even fresher crop of startup founders.

We’ve been experiencing one of the longest economic expansionary periods since the industrial revolution, which manifests itself not only in the stock market’s bull run but also in venture financings. It reminds me a lot of 1998, when my co-founder and I had our pick of prospective investors who were clamoring to invest in our internet startup.

In Europe in particular, this stretch probably feels especially gratifying to entrepreneurs. The bulk of my VC career has been in Europe (2001-2015), and during much of that period, capital was scarce and VCs were relatively risk-averse, tilting the balance of power toward investors rather than in favor of the startups.

I benefited from that environment of capital scarcity; it felt like a buyer’s market for many years. However, I always consciously strived to be founder-friendly in my approach to investing. I suspect that driving my philosophy were two factors. As a former entrepreneur myself, I’d like to believe that I held genuine empathy for the founders I met. Another perhaps less altruistic factor was that this approach gave me a differentiator in the market, since very few other VCs behaved this way at the time.

This balance has unmistakably shifted the other way over the past couple years. Record funding tickets in the 100s of million euro range no longer raise eyebrows, ticket sizes practically unheard of only a few years ago.

Startup founders of the most compelling startups have more options in funding sources. They can be discerning among the VCs they choose for their cap tables.

A few veteran French founders I know have not forgotten the VCs that snubbed them in the past. Now on their second or third startups, some of these individuals have gone on to create unicorns and centaurs. They now find themselves in the driver’s seat among investment suitors.

However, if there’s one thing I learned having experienced a few economic cycles, it’s that what goes around comes around. It might seem hard to fathom doing these exuberant times, but I encourage all entrepreneurs who have the luxury of choice in these times to stay on good terms with any investor who courts them. Eventually the pendulum swings back in the other direction. It always does.