A couple days ago I released a stream of consciousness tweetstorm about Nomura’s sudden and substantial goodwill impairment following 11 years of radio silence.

I intended to provoke and expected some feedback on it. What I did not expect was the near consensus condemning the financial integrity of many corporate balance sheets in Japan.

The impairment of ¥81 billion related to the goodwill resulting from Nomura’s 2007 and 2008 acquisitions of Instinet and Lehman Brothers APAC, respectively. Total consideration for both acquisitions was $1.7 billion, so the goodwill impairment represented approximately 43% of the total consideration.

For clarification, I am not criticizing the lofty amount of the impairment. On the contrary, if we recall the context of September 2008, Lehman’s book had just collapsed. Goodwill represented a substantial component of the acquisition price.

Both Japanese natives and foreigners with long-term experience in Japan were equally critical. Many of the replies took the form of private messages or conversations, so I will keep them anonymous, but here’s a smattering of the most salient:

“If you think this is bad, you should have been here in the 90s.”

“Shareholder transparency in corporate Japan has come a long way but still has a long way to go.”

“Shenanigans like this are pretty standard. Just take a look at Olympus, Kobe Steel, Takata, Toshiba, etc.”

“The fact that Nomura took its goodwill impairment now means that the original person responsible for the acquisitions has either died, retired, or left the company.”

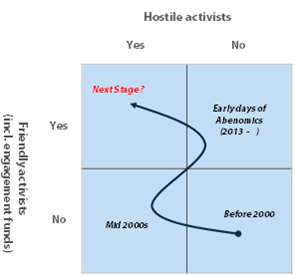

Paradoxically, I interpret this condemnation as a positive signal for corporate Japan. It appears that shareholders activists have also taken note.

Here’s the full tweetstorm for reference.