A fun parlour game these days is to speculate on which major developed country will be the first to announce that it is storing a significant portion of its treasury reserves in Bitcoin.

I’ve noticed that not only Bitcoin maximalists enjoy playing this game; even crypto-skeptics will usually indulge too.

All but the most ardent critics of Bitcoin can appreciate the rationale for a sovereign nation to allocate at least a portion of its reserves into the leading cryptocurrency.

Economies with runaway inflation have an obvious reason to do so, as do pariah states which need to circumvent sanctions.

Yet a compelling argument also exists for open countries with developed economies to adopt it for its sovereign reserves: Bitcoin as insurance.

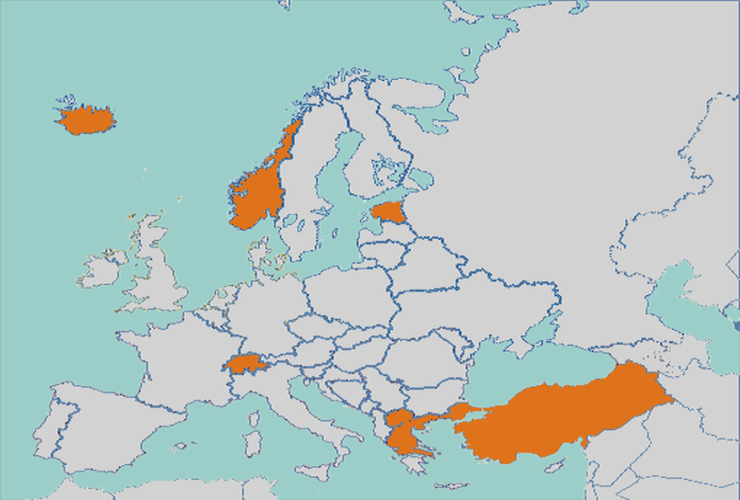

When I try to imagine which countries in this category will be the first to make such an announcement — and I expect that there will be one in the near future — my first reflex is to think of Estonia.

As I’ve extolled in the past, Estonia is one of the most forward-thinking Western countries to embrace technological innovation. For anyone who has not experimented with it yet, I encourage you to seriously consider becoming an Estonian e-resident. Estonia, however, has adopted the Euro, so it does not have sovereignty over its monetary policy, effectively limiting its margin of maneuver when it comes to allocation of treasury reserves.

Across the Baltic Sea, Nordic countries that have not adopted nor are pegged to the Euro, logically come to mind next: Sweden, Norway, or even Iceland.

Iceland still carries scars from the 2008 Great Financial Crisis and also benefits from a healthy supply of geothermal energy sources conducive to Bitcoin mining.

Norway has historically demonstrated sound financial foresight in managing its oil reserves, not to mention it’s recent positive signals around Bitcoin from firms like Aker and local billionaires.

A friend reminded me not to exclude Switzerland from the list of potential candidates for a major Bitcoin announcement, and with good precedent. The Swiss National Bank for years has allocated a portion of its reserves to holding alternative assets, such as U.S. tech stocks.

Perhaps even an elephant-size economy could make such a move. Usually when my friends and I play this game, we quickly exclude the United States, China, and Japan, without any dissenting views.

However, Balaji Srinivasan makes a compelling case that India should launch a digital rupee and back it with digital gold as its primary currency reserve. In this excellent piece, Balaji lays out several reasons, many of which could apply to numerous countries. I recommend reading his whole thesis, but here is a summary of some of his points of rationale:

- National security to prevent financial de-platforming

- Attraction of foreign capital

- Conduit for remote work and remittances

- Strengthened monetary policy: a digital rupee backed by digital gold

- Deterrence of financial fraud

- Enhanced technological progress

- An open source alternative to foreign corporations

- A decentralized neutrality in contrast with the looming financial cold war between the U.S. and China

Finally, in light of the recent events over the past week involving its Central Bank head, Turkey comes to mind as an interesting candidate. Turkish interest in crypto has been growing for years. I recall interacting with an active crypto community in Istanbul before the 2017 bull run. Admittedly purely anecdotally, it felt like everybody of all ages in Istanbul had Bitcoin on their mind back then. I imagine that public interest has only grown substantially since.

What do you think ?

content wrote:

content

blog topic

Link | August 7th, 2022 at 06:10

entrepreneurship wrote:

entrepreneurship

blog topic

Link | September 7th, 2022 at 07:00