Over the summer I had a conversation with an innovation offered officer inside a large European retail bank. There was a fair amount of lamenting about regulatory burdens (I’m looking at you FATCA) as well as the emerging threat posed by burgeoning challenger banks and other consumer fintech services.

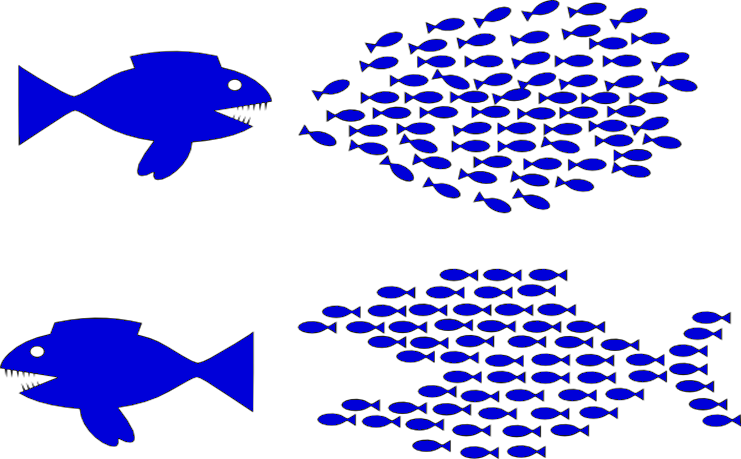

By trying to serve large volumes of customers, traditional banks’ most profitable clients often end up subsidizing the least profitable. Agile challenger banks can outmaneuver the incumbents by cherry-picking the latter’s best and most profitable customers — such as by restricting their product to a narrow elite group — and ignoring the rest. Innovators are also applying new technologies like machine learning to uncover correlations that generate new insightful data sets, in turn enhancing their segmentations and pricing strategies (think of a mobile fintech app which monitors the other apps on our phones, whether we text while driving, our spending habits, our phone charging patterns etc., and uses that data to inform pricing or assess risk).

One shocking revelation during my aforementioned conversation with the banking officer was that he personally had not become a customer of any of these new consumer fintech products. How could he possibly understand the ramifications of these new innovations without trying them himself?, I wondered. This behavior is not unique to incumbent banking institutions; heck I’ve even witnessed VCs who do not habitually try out the relevant products on offer in their domain of investment.

Chalk it up to my inner technology nerd or perhaps it’s more nobly due to intellectual curiosity, but I find it my obligation if I’m investing in the space to do my best to get a feel for the various products out there as a customer (and yes, I applied this similar logic before investing in mobile gaming startups).

So in espousing such a ‘work ethic’, I sacrificed a chunk of my summer holiday sampling some of the new services from European startups which are revolutionizing retail banking for consumers. A while back I had promised to publicize my assessment of some of the consumer fintech products on the market in Europe, so here is making good on that promise. [Note the following reviews are purely from the standpoint of an independent consumer. I am not an investor in any of these companies (although in many cases wish I were) nor am I compensated by the companies to write about them. I’ll share referral codes with sign-up bonuses in the event that you would like to try the products yourself; any eventual referral bonuses that I receive in return are redirected to Japan’s Tohoku region.] This list is in alphabetical order to avoid any implicit rankings.

CurrencyFair

CurrencyFair established itself early on at the core plumbing level of foreign currency exchange. The company was one of the pioneers in democratizing forex for the consumer. I’ll always have a soft spot in my heart for CurrencyFair ever since some five years ago during a month-long stint in Bangkok when I grew quickly weary of excessive spreads on converting my overseas funds into Thai Baht. So I opened a local bank account in Thailand and placed an out-of-the-money limit order on EUR/THB on CurrencyFair. Once the order was filled, I transferred the THB from CurrencyFair into my local Thai bank account, saving a boatload of Baht on bank fees. Transfers into the CurrencyFair account are free inside the SEPA zone, and with the set-your-own-exchange-rate feature, the product is handy for international travelers or freelancers operating in multiple currency jurisdictions. Perhaps the only glaring omission in CurrencyFair’s offer the lack of a mobile app. [CurrencyFair referral link]

Curve

Due to my own idiosyncrasies and my cultural upbringing, it turns out that I possess a fairly high number of credit credit and debit cards. These cards span multiple geographies and currencies. I cannot possibly carry them all on my person at all times. However, the one card that I do keep in my wallet ubiquitously is the Curve card. Curve’s Mastercard represents one of the four pillars of the UK startup‘s ambition to become the O/S of money. In contrast with typical credit cards, the Curve card does not link to a single unique bank account. Rather, it connects via Curve’s mobile app to any number of other credit or debit cards of your choosing. Simply select the underlying credit/debit card you wish to use for payment prior to each purchase. Even up to 14 days after the purchase, you can go back in time and switch the card used in the given transaction. Delightful simplicity. Not only that, but the email-a-receipt option and business expense labeling renders the card incredibly practical if you have multiple companies or projects to manage. [Curve card referral link]

Monese

Monese offered by far the smoothest and most painless onboarding process of any consumer fintech product I have ever tried (Silicon Valley: are you listening ?). Snap a photo of your passport with their app and then within the same app take a selfie video. A couple days later your free Mastercard debit card arrives in the post. The card functions as a prepaid debit card linked to wallets on their handy mobile app in EUR or GBP currencies for the moment. [Monese referral link]

N26

N26 offers mobile-first current accounts for both personal banking and freelancers. Similar to Monese, the application process is entirely automated inside their mobile app. In contrast with Monese, N26’s process did not seem to work quite so smoothly, at least for me on two separate occasions. Human intervention eventually resolved the problem but not without chasing their customer support for a few weeks. Once established, however, the product’s unique IBAN accounts and superb user experience in the mobile app make the N26 banking product second to none. The N26 debit Mastercard comes in three flavors: free, premium, and metal. [N26 referral link]

Revolut

Revolut’s ingenious claim to fame was their offer of currency exchange at the interbank rate, exposing the consumer price gouging practiced by traditional banks with their egregious spreads. It’s almost poetic how Revolut brought institutional unfair advantages in currency exchange to the little guy. The clever maneuver propelled the company to 2 million active users (some even suggest its growth was too rapid). Revolut’s product is entirely mobile-only (the lack of a web interface irks some) and is packed with handy features like location-based security, card spending limits or freezes, and peer-to-peer transfers in about 30 different currencies. Revolut offers accounts for personal, freelancer, business users, with their newest business account at pricing tiers attractive for businesses of all sizes (including a free account). I have noticed that Revolut seems to be watering down their interbank rate benefit on business accounts which will mitigate one of their key advantages over Transferwise’s Borderless account (see below). Revolut also offers physical (prepaid debit) cards in three flavors: free, premium, and metal. [Revolut referral link and Revolut business referral link]

TransferWise

One of Estonia’s four unicorns (elagu Eesti!), TransferWise staked out an early leadership in cross-border payments and pioneered an international payment account for small businesses with their Borderless Account. This is one of the few European fintech firms offering business accounts for which U.S. legal entities are eligible. The product supports foreign currency transfers to over 60 countries. TransferWise offers its Borderless Account to businesses for free, and generates revenue in the form of a transparent fee upon currency exchange or money transfer. [TransferWise referral link]

In a future post I will review some of the fintech solutions for consumers and small businesses in other world geographies, notably including Japan which still has a ways to go in its quest to increase cashless adoption.