I have to confess that I find this phenomenon of crypto-enabled decentralized prediction markets for the U.S. election intellectually fascinating.

I recall watching an episode of a science fiction show as a kid in which citizens of some dystopian nation state would vote online in real-time to political speeches. The politicians would adjust their discourse in response to the voters’ reactions, also in real-time. The ultimate outcome of this civic behavior led to a vapid system of governance in which the political leaders would tell the governed whatever was necessary to remain in power. All other mechanisms for feedback and accountability withered away.

Now that I reflect on it, this sci-fi episode from decades ago proved incredibly prescient. The U.S. presidential election campaign has mercifully not yet reached such a level of dystopia, but it would be hard to argue nowadays that such a scenario is entirely implausible.

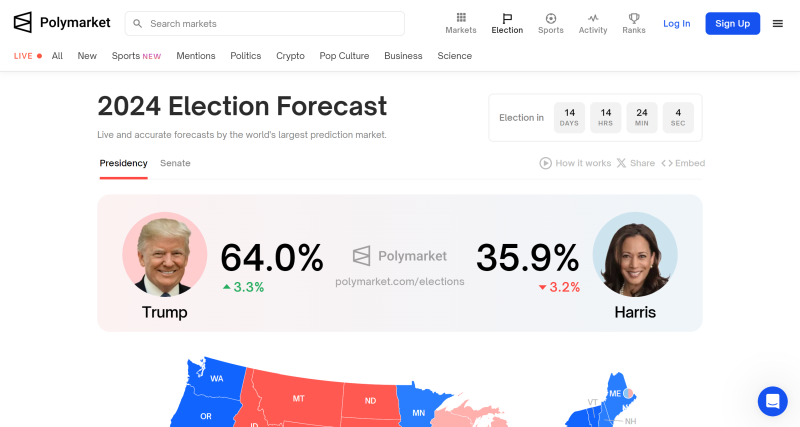

This brings me back to my intellectual fascination with the new generation of decentralized prediction platforms like Polymarket and Augur.

Prediction markets are not new, even for political races. Political betting apparently dates back to the 16th century, when people would wager on the selection of the next Pope. The University of Iowa introduced its Iowa Electronic Markets during the 1988 U.S. presidential election, representing one of the first modern electronic prediction markets.

Polymarket and its peers narrow the gap to the real-time horizon of that sci-fi show. The crypto rails provide a feedback channel that is instantaneous, universal, and ’round-the-clock. Anyone with access to a smart phone or computer can create their own secure wallet and employ it as their ballot, 7 days a week, 24 hours a day.

Just like in financial markets, I believe that the concept of market efficiency will come to dominate real-time prediction markets. However, I would posit that these platforms today sit a ways off from even weak-form efficiency, at least for now.

For one reason, the user base of decentralized prediction platforms is not representative of the actual market. Although in theory these tools are accessible to anyone with a web3 wallet, the selection bias toward crypto early-adopters is strong. Moreover, visionaries (ahem) like the current chairman of the SEC prohibit U.S. citizens from accessing Polymarket, so the punters on the U.S. presidential election results are not actual voters.

Rather, my sense is that for the moment these crypto prediction markets behave more like vehicles to shape the narrative, leveraged by a niche group. Today’s 24-hour news cycle, relentlessly in pursuit of the next tidbit of breaking news, serves the role of useful idiot by reporting on the prediction market spread constantly. If the candidates begin to attribute more credence to the prediction market data and adjust their policy positions accordingly, the aforementioned childhood sci-fi show will appear far less far-fetched.