“Why invest in a security token ?”

That was how the conversation started with some co-investor friends over wagyu dinner in Tokyo the other night. The question was triggered by the collective observation of the sudden spike in deal flow these days from projects raising funds for their ‘security tokens’. One example cited was that of a project which employs security tokens to sell fractional ownership to a building in Chicago. Setting aside the fact that it was practically colder than Mars in Chicago this month (#polarvortex), if I wanted that kind of exposure my first instinct would be to simply invest in a low-fee, time-tested real estate investment trust (REIT).

The aforementioned dinner was part of a quarterly habit to get together for pseudo-intellectual banter about startup deals we’re looking at (which in a nod to N N Taleb I’ll simply characterize as “intellectual assessment”). We try to not go too deep on a topic, as any self-respecting capital allocator would understand.

[My intention in this piece, however, is not to debate the merits of security tokens. Before moving on though, I submit that there seems to be a conflation of the terms ‘security tokens’ and ‘tokenized securities’. These are two different concepts and accordingly should be treated with distinction. For a thoughtful explanation on this distinction, I recommend this article.]

No, my intention in this blog post is to address an eternal question I continue to receive from crypto projects outside Japan:

How can I raise funds for my ICO (or more recently, STO) from the Japanese market ?

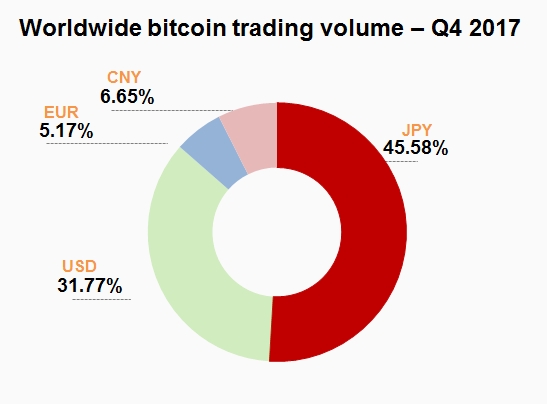

It’s a fair question, and I understand the appeal of Japan for crypto to outsiders looking in. As I explained in Japan Bitcoin #1, Japan was (and still is), the world’s largest country for bitcoin trading, surpassing even 50% of worldwide trading volume at times.

I wrote that book in 2017 because I was an ignoramus about Japan’s retail dominance in bitcoin and set out on a mission to find explanations. During the ICO frenzy of 2018, I was inundated with solicitations for guidance on tapping the perceived crypto goldmine in the land of the rising sun.

In contrast with the world’s other two largest economies, the U.S. and China, Japan at the time espoused a constructive governance framework for cryptocurrency projects. For reasons which I evoked in the book, Japan’s fairly innocuous regulatory context may well have opened a window for outside crypto endeavours to tap into the well here.

Regardless, the edges of the gray zone most certainly became less blurred following the hack of Coincheck — a leading fiat-to-crypto exchange in Japan — in early 2018.

A regulator’s job is to protect the public, and when an exchange exposes consumers to unnecessary risk with lax security controls, it is natural that regulations tighten. In this case, in Q2 2018 Japan’s FSA ruled that all domestic cryptocurrency trading activities require a cryptocurrency exchange license. This requirement covered of course all crypto exchanges, but crucially, even applied to any ICOs targeting the Japanese market.

In other words, a blockchain project based anywhere in the world that wished to sell tokens to residents of Japan would need a Japanese cryptocurrency exchange license to do this legally. Obtaining a cryptocurrency exchange license in Japan was far from trivial (I can attest from direct knowledge that the licensing process encompasses not only extensive paperwork but also demonstrable execution). At its peak, over 100 applicants languished in a 12-month processing queue; several firms abandoned mid-way.

A regulatory freeze

Naturally, this broad regulatory brush generated criticisms of overreach. It effectively closed off Japan as a source of funders for ICO projects, despite the appetite. Unsurprisingly, some projects found ways to circumvent the rules, but even most loopholes were eventually shut down.

The ensuing crypto winter and waning crypto speculation have actually created some breathing room now. Almost all of the operational Japanese crypto exchanges have obtained their license (including Coincheck, which is now is the much safer hands of Monex Securities). Japanese regulators are slowly catching up on the unwieldy backlog of license applicants.

As more companies obtain their crypto exchange license in Japan, solicitations for partnership are also on the rise. Some forward-thinking foreign token projects who wish to prospect on the Japanese market are exploring whether they can partner with a licensed exchange in Japan in order to comply with the regulation.

A legal path to ICO compliance in Japan ?

The answer to this question is: technically yes. A licensed cryptocurrency exchange can technically extend its licensed status to partners if configured properly. However, the devil is in the details.

Furthermore, and perhaps more importantly at this point, the Japanese regulator is not (yet) approving new tokens for trading in Japan. So this means that even you’re technically in compliance in soliciting investors from Japan for your ICO, it is unlikely that your token will be allowed to be traded on an exchange in Japan, at least for now.

“No worries,” you might think. “We’ll just list our token on exchanges outside of Japan.”

The trouble with this line of reasoning is that: i) it eliminates the vast majority of eligible participants from Japan, and ii) it eliminates the incentive for the Japanese exchange to partner with your project in the first place.

Wait for the spring…

The regulatory landscape for cryptocurrency in Japan is still in flux. I would not be surprised if we witness more direction in the coming months, as April in Japan often marks the beginning of a new year for many organizations from a fiscal and governance perspective. Additionally, corporate blockchain projects in Japan — many of which I’ve discussed in Land of the Rising Blockchain — are quietly but steadily progressing behind the scenes.

Accordingly, I remain optimistic. We’ll see…