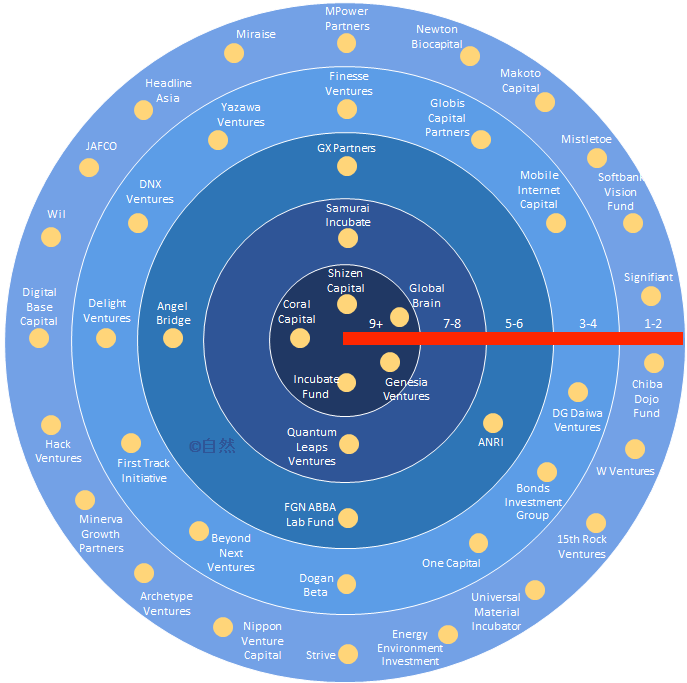

The infographic we published last month proved popular. Some of the most encouraging feedback we received came from abroad, where foreign investors in the venture asset class expressed appreciation for visibility into Japan’s most active VC Funds. Even domestically, it appears that many local startup founders in Japan find our VC sector here equally opaque, and hence applauded this new transparency.

This collective feedback has inspired us to peel back one more layer of the onion: identifying Japan’s most active Lead VC funds.

What defines a Lead VC?

Quite simply, a Lead VC in a startup is the first venture capital fund to commit to a startup’s fundraising round. The Lead VC structures the investment round, establishes the terms and valuation in a term sheet, and sets the schedule for transaction closing. In Western markets, the Lead VC often represents the largest check in the round, though not necessarily, and this is far less common in Japan.

Japan Lead VC Radar 2021

Accordingly, the Japan Lead VC Radar™, 2021 edition depicted below, reflects the number of investments led by Japan’s independent VC funds into domestic startups in 2021. In a future post I will elaborate on why we believe this is an important tool for Japan’s growing venture ecosystem. [Note: please direct any requested corrections to infographic@shizen.vc].