Last week I wrote a piece about playing to your strengths. Because I’m not a macro trader, I wasn’t exactly playing to my strengths when I decided to bet against the S&P 500 a few months ago. Although I was directionally right, my timing was a bit off, so I wound up leaving money on the table.

The penalty for leaving money on the table has grown disproportionately over the past two years. Former ECB President Mario Draghi’s “Whatever it takes” mission ushered in a new era of near-zero or even negative interest rates.

To borrow a clever expression from Diego Parrilla, successful hedge fund trader and author of The Anti-bubbles, we’ve moved from a paradigm of “risk-free interest” to one of “interest-free risk.”

Both current and former central bankers are already making pronouncements about the urgency to loosen monetary policy even further in the wake of last week’s plummeting stock markets. This suggests to me that our low-interest-rate paradigm is not going to change anytime soon.

In an environment with tight margins of maneuver for returns, minor missteps can be costly. For example in France right now, the government-backed Livret A liquid savings account offers an interest rate of 0.75%. That’s high in today’s environment, especially once adjusted for its absence of risk (provided you have faith in the French government). Compare that with, say, the variety of crowd-lending platforms available to the general public that offer interest rates of 4% to 5% on loans to European SMEs. These crowd-sourced loans are amortized immediately on a monthly basis, so in reality a 4% rate would be the equivalent of closer to 2% were you to keep your money locked up in a savings account or certificate of deposit over the course of the same year. And yet the crowd-lending platforms involve non-negligible default risk, which means that on a risk-adjusted basis the justification for their return premium vs. a secured savings account or CD is unclear at best.

Regardless, placing your money into a secured savings account like that fully liquid Livret A, even if it only pays 0.75%, is clearly superior to keeping it under the mattress. This is intuitive to most people.

Less intuitive is that the same phenomenon repeats itself in cryptocurrency.

Setting aside high-volume day traders, there are many other segments of people who hold cryptocurrencies for reasons other than active daily trading. These could include for instance technologists who are interested in putting skin in the game as they explore this transformational new innovation, or cryptocurrency zealots (hodlers) who are convinced of the long-term value of crypto, or even simply people who deem it wise to allocate a small fraction of their assets into cryptocurrency as a hedge against other asset classes.

For most of these groups, their cryptocurrency assets are merely sitting idle. This is the equivalent of sticking their cash under the mattress when they could earn interest in a secured savings account. With the burgeoning variety of crypto staking and lending solutions emerging on the market, even short-term holders can derive value from their cryptocurrency without actively trading it. The return profile obviously depends on the level of assumed risk, yet whatever your risk appetite, pushing your crypto assets to the risk/return efficient frontier makes more sense than letting them sit idle, or worse letting a crypto exchange stake them or lend them out on your behalf, and capture the profits for themselves.

I was curious how much cryptocurrency might be hiding under the metaphorical mattresses out there, but I had assumed that this data was impossible to measure.

It turns out that I was mistaken. This data can indeed be measured, as I learned from a conversation just the other day with one of the smartest blockchain entrepreneurs I know.

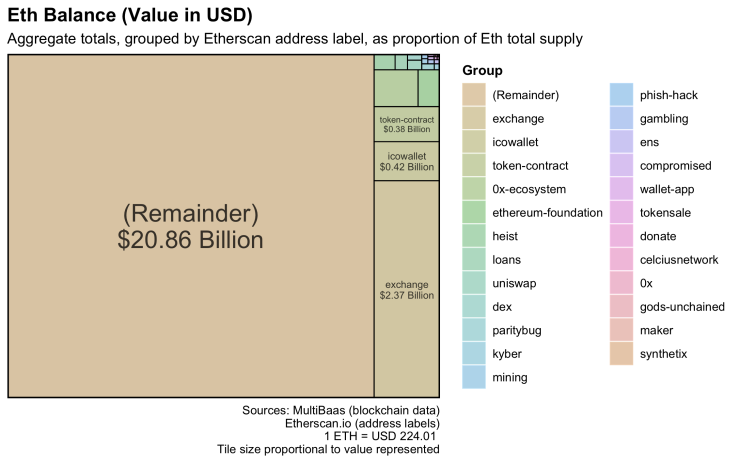

Curvegrid‘s MultiBaas technology platform is able to calculate the volume of such idle cryptocurrency. How they’ve accomplished this is way above my pay grade, and I will need several subsequent discussions to even remotely comprehend it. I asked them if they could give me an order-of-magnitude estimate of the sum. So as a favor to me, their smart team performed a little research and generated the report below.

Want to hear something mind-blowing ?

20 billion dollars.

That is the value of ETH sitting idle out there in the ether (apologies for the pun).

This represents over 80% of the total market cap of ETH !

A lot of people are leaving a lot of money on the table. I’m still processing what the ramifications of all this could mean for retail investors, cryptocurrency exchanges, and regulators. I anticipate revisiting this topic again soon.