Conventional wisdom of asset allocation held for decades that a balanced 60/40 portfolio (equities/bonds) would provide investors with a relatively safe and straightforward way to diversity their holdings and enjoy healthy returns with low volatility. The pandemic, however, decoupled the link between economic growth and inflation, reducing bonds’ ability to soften losses in stocks and hampering financial returns.

The smart folks over at Crypto.com have published a report analyzing efficient frontiers of portfolio allocation by including a fraction of crypto assets (note: please do not call them ‘crypto asset securities’, a specious term ruled to have no legal grounding).

The CDC report integrates cryptocurrency and traditional finance vehicles to explore how asset allocation affects portfolio performance and risk, and applies the Modern Portfolio Theory to build portfolios that maximize overall returns within an acceptable level of risk.

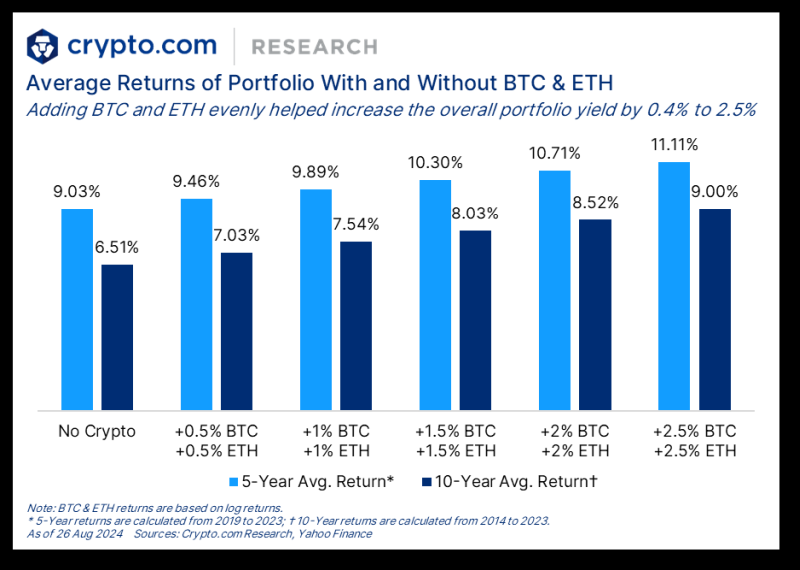

Punchline: adding BTC to investors’ portfolios could help increase yield by up to 2.0% annually without significant impact on volatility. A directionally similar effect showed that adding both BTC and ETH could increase overall portfolio yield up to 2.5%, with limited impact on overall risk.

Here are some more key takeaways of the report:

- Without adding crypto assets, a portfolio consisting of the S&P 500, Core US Aggregate Bond, Gold, and REIT can achieve a maximum Sharpe Ratio of 0.7050, with the return, risk (volatility), and risk-free interest at 9.61%, 0.1161, and 1.44%, respectively.

- One optimal portfolio is found when adding BTC as the only crypto asset with limited weight (less than 5%). The corresponding return and risk are 10.67% and 0.1106, respectively, with a Sharpe Ratio of 0.8345.

- Another optimal portfolio is found when adding both BTC and ETH with limited weights (less than 5%). The corresponding return and risk are 11.43% and 0.1047, respectively, with a Sharpe Ratio of 0.9539.