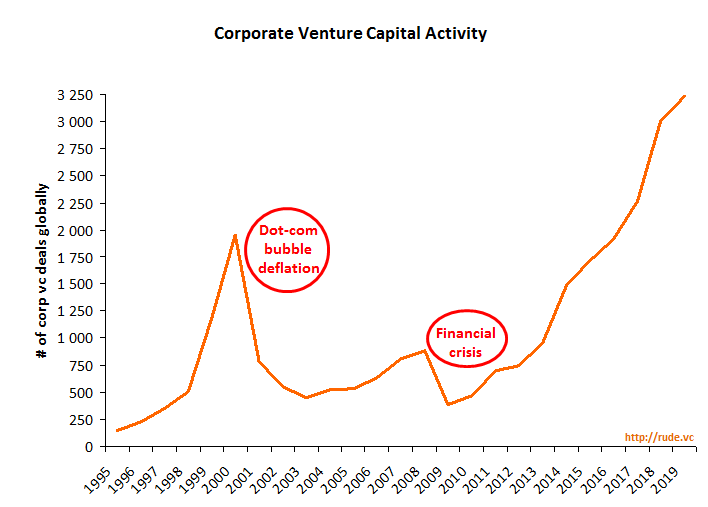

Five years ago I published a chart of global corporate venture capital activity since 1995. Here is this same chart updated with data through 2019.

Corporate venture capital units (CVCs) serve an important function, and I’m not here to knock them. I even spent the early part of my VC career working for a corporate venture fund, which afforded me the opportunity to witness both the benefits and the challenges of CVCs from the inside.

As enterprises increasingly confront and embrace digital transformation, the CVC business units can represent a bridge from the parent company to outside innovation. The challenges for CVCs tend to present themselves at both the level of construction and at the level of execution.

By construction, CVCs are often designed with two distinct objectives: i) generate financial return and ii) generate strategic value for the corporate parent. Everything works fine when these objectives coincide. However, these goals can be orthogonal. Optimizing for one may undercut the other.

As a simple example, preventing a CVC portfolio company from selling its innovative technology to the corporate parent’s direct competitor may be appealing strategically for the parent corporation but would hamper the financial return of the investment. Incentives also present challenges. CVCs are often hard-pressed to offer market remuneration to professional fund managers in the way that independent VC funds do.

The above is a very superficial summary; the distinctions between CVC and independent VC funds are both broader and more nuanced. Furthermore, best practices of corporate innovation usually involve creating a CVC unit and also in parallel becoming an LP of an independent VC fund. I’d be happy to offer deeper insights on the above for anyone interested.

The point of this piece is merely to examine the data. Historically, CVC deal activity plummets following major economic crises. This phenomenon underscores a CVC’s inherent tension between financial return and strategic return. As history has demonstrated time and again, venture investments made in the aftermath of a crisis often generate the highest financial returns across the asset class.

Moreover, I submit that such post-crisis investments also generate compelling strategic value for the corporate parent, as some of the greatest innovations are conceived during a crisis. This remains conjecture at this point, however, and could represent a good thesis topic.

It is too early to determine whether the 2020 recession will scare off the CVCs again this time. For their sake — and for the sake of the domestic venture ecosystems too — I hope not. Time will tell.