It’s hard to walk around Tokyo these days without hearing the buzz of construction equipment.

In this city of perpetual renewal, new building construction in Tokyo seems to occur year-round. The phenomenon is repeating itself in many other of Japan’s major cities (Osaka, Kobe, Fukuoka, etc.), although it’s certainly most prominent here in the capital. Mercifully, Japanese construction techniques diligently restrict the decibel levels so as not to disturb residents or passersby. Furthermore, projects seem to progress efficiently from start to completion within a timeframe in which they’d still be holding planning meetings for an equivalent effort in Paris.

Construction of office and co-working space in Tokyo this year is proving particularly active, driven in my opinion by two superimposing waves: i) the preparations for the 2020 Olympics, and ii) the wave of hunger for attracting innovation that is currently washing across Japan.

The Japanese real estate developers are of course riding the crest of these two superimposed waves. Large firms like Mitsubishi Estate, Mitsui Fudosan, Mori Trust, Tokyu Land, as well as others which may be less familiar to foreigners such as Nippon Steel Real Estate and the Apaman Group are leading such efforts in the elusive pursuit of “innovation.” Such groups are building out startup hubs and co-working facilities in order to satiate the expected flurry of demand from domestic and foreign startups interested in scaling in Japan.

Meanwhile, foreign substitutes like WeWork have already established a significant foothold in Tokyo, with several locations having already reached full occupancy ahead of schedule.

Two takeaways from this euphoria

I draw two conclusions which I think might be relevant from all this euphoria.

First, if you’re a startup looking for office space in Tokyo or other Japanese major cities, there may soon be a glut of it, especially after next summer’s Olympics are over.

Secondly, for startups working on innovative tech in the real estate sector, a compelling market is emerging here for you in Japan. Whether it be property management tools, construction tech, blockchain-based real estate solutions, commercial and residential marketplaces, etc., there is demand.

I remember some years back hanging out with the founder of France’s PopUp Immo, a platform for pop-up shops, on a visit here to explore the appeal of entering the Japanese market. At that point in time, he determined that the Japanese market was not ready, and instead set his sights on the U.S. Since then, PopUp Immo has acquired the leading U.S. counterpart, StoreFront, and now represents the undisputed global leader in pop-up retail (deep respect, Mohamed !).

Clearly in retrospect, Mohamed’s decision to prioritize the U.S. market over Japan was the right one at the time. Had he faced the same choice today, however, I suspect the calculus might be a bit different.

Japan is facing macroeconomic challenges of epic proportions. The demand for innovative startups, both domestic (where there are not enough) and globally has never been stronger in all the years that I’ve traveled here.

Calling all real estate tech

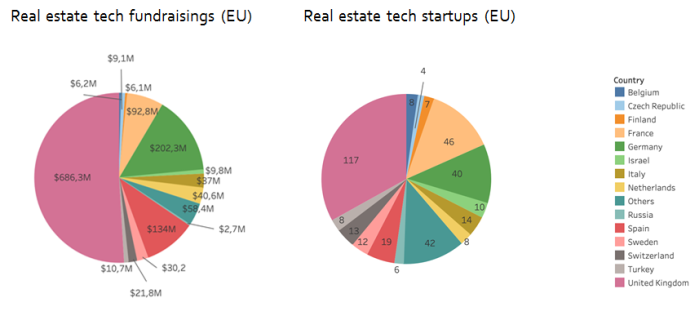

Given the paucity of real estate technology startups in Japan, I’ve been screening for innovative projects abroad, mainly focused on Europe, where they are in abundance. I’m currently tracking a deal flow database of over 100 startups in Europe operating in the sector. Furthermore, thanks to our friends over at PitchBook, I understand that there are over 350 European tech startups operating in or closely adjacent to the field of real estate. Here’s a smattering of some of the data that I pulled from PitchBook base:

For tech startups working on innovation for real estate, if you’re interested in raising funds to explore the Japanese market, I would love to hear from you.

すべての不動産テックスタートアップよ、日本に来たれ!【ゲスト寄稿】 - THE BRIDGE(ザ・ブリッジ) wrote:

[…] guest post is first appeared on Mark Bivens’ Blog. Mark is a Paris- / Tokyo-based venture […]

Link | July 22nd, 2019 at 07:22